An Overview of the U.S. Federal Reserve and Its Role in the Economy

The U.S. Federal Reserve, or the Fed, is the central banking system of the United States. The Fed is responsible for monitoring and regulating the nation's banking system, as well as providing economic guidance through its monetary policy. The Fed's primary goals are to maintain a stable economy and foster economic growth.

The Federal Reserve System is composed of a Board of Governors, 12 regional Federal Reserve Banks, and numerous other economic advisory committees. The Board of Governors is the main governing body, comprised of seven members appointed by the President of the United States. The Federal Open Market Committee (FOMC) is the primary policy-making body of the Federal Reserve System, and is composed of the seven members of the Board of Governors, five of the 12 regional bank presidents, and the President of the Federal Reserve Bank of New York.

The Federal Reserve System has several key roles in the U.S. economy. First, the Fed is responsible for setting the nation's monetary policy. This involves setting the target federal funds rate, which is the interest rate at which banks borrow from each other overnight. The Fed also sets the discount rate, which is the interest rate at which banks can borrow directly from the Federal Reserve. By setting these interest rates, the Fed can influence the amount of money in circulation, which in turn affects economic activity, inflation, and employment.

The Fed is also responsible for regulating the banking system. The Fed sets rules and regulations that banks must follow to ensure the safety and soundness of the banking system. This includes setting capital requirements, which is the minimum amount of money that banks must hold in reserve to cover potential losses. The Fed also sets rules to protect consumers, such as the Truth in Lending Act, which requires banks to disclose all terms and conditions of a loan to the borrower.

Finally, the Fed is responsible for providing economic guidance and stability. The Fed monitors economic data and uses its monetary policy tools to help foster economic growth and reduce unemployment. The Fed also works to maintain a stable financial system by providing liquidity to banks and other financial institutions, in order to ensure that they are able to meet their obligations.

The U.S. Federal Reserve plays a critical role in the nation's economy. The Fed's actions influence the amount of money in circulation, the cost of borrowing, and the stability of the financial system. By setting the nation's monetary policy, regulating the banking system, and providing economic guidance, the Fed works to ensure a stable and growing economy.

Exploring the Structure and Function of the U.S. Federal Reserve

The U.S. Federal Reserve is the central banking system of the United States and one of the most influential financial institutions in the world. Established in 1913, the Federal Reserve System, commonly referred to as the Fed, serves as the nation's “banker” and is tasked with maintaining the stability of the U.S. financial system. The Fed is composed of 12 regional Federal Reserve Banks and a seven-member Board of Governors, appointed by the president and confirmed by the Senate.

The Fed is responsible for conducting monetary policy, which includes setting the federal funds rate, the interest rate at which banks borrow money from other banks overnight. This rate influences the availability of credit, the cost of borrowing, and ultimately, the rate of inflation. The Federal Reserve also regulates the banking system, ensuring that banks are operating responsibly and maintaining the safety and soundness of the financial system.

The Fed has other responsibilities as well, such as providing payment services to the federal government, supervising and regulating state-chartered banks, and serving as the government's fiscal agent. In addition, the Fed provides financial services to foreign governments and central banks, as well as private sector institutions.

The Federal Open Market Committee (FOMC) is the Federal Reserve's primary tool for implementing monetary policy. The FOMC is composed of the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four other Reserve Bank presidents. The FOMC meets regularly to discuss the outlook for the economy and to determine the appropriate setting of the federal funds rate.

The Fed's ability to respond to changes in the economy is crucial to its success. The Fed has the power to increase or decrease the money supply, which can be used to stimulate the economy during downturns or to reduce inflation during periods of economic growth. The Fed's ability to effectively manage the economy is a key reason why it is one of the most powerful economic institutions in the world.

Exploring the History of the U.S. Federal Reserve and Its Impact on the Economy

The United States Federal Reserve is the central banking system of the United States. It was established in 1913 by the Federal Reserve Act. The Fed, as it is often referred to, is responsible for the nation's monetary policy, including setting interest rates and controlling the money supply. The Fed also acts as a regulator of the banking system and ensures that banks are operating in accordance with the law.

The Federal Reserve was created in response to the financial panic of 1907. At that time, the nation's banking system was in disarray, with banks unable to meet the demand for funds. The Federal Reserve was created to provide stability to the banking system and to act as a lender of last resort. The Federal Reserve was also designed to help regulate the money supply, ensuring that there would be enough money in circulation to meet the needs of the economy.

The Federal Reserve is composed of a Board of Governors, a Federal Open Market Committee, and 12 regional Federal Reserve Banks. The Board of Governors is responsible for setting the nation's monetary policy. The Federal Open Market Committee, or FOMC, is responsible for setting the federal funds rate, which is the interest rate at which banks borrow from each other. The 12 regional Federal Reserve Banks are responsible for conducting monetary policy and overseeing the nation's banking system.

The Federal Reserve has had a major impact on the economy, particularly in the areas of inflation, employment, and economic growth. By controlling the money supply, the Federal Reserve can influence the rate of inflation and the level of employment. By setting the federal funds rate, the Fed can also influence the level of economic growth. The Fed can also affect the exchange rate of the US dollar and the availability of credit.

The Federal Reserve has been one of the most influential institutions in the US economy since its creation in 1913. By controlling the money supply, setting interest rates, and regulating the banking system, the Federal Reserve has had a tremendous impact on the US economy. It is one of the most important institutions in the world, and its actions have a significant effect on the global economy.

Examining the Impact of U.S. Federal Reserve Decisions on the Financial Markets

The U.S. Federal Reserve is the central bank of the United States and has been the leader in setting monetary policy since 1913. It has the power to raise or lower interest rates, which can significantly impact the financial markets. When interest rates are low, investors are more likely to invest, and businesses are more likely to expand. Conversely, when interest rates are high, investors are more likely to pull back, and businesses are more likely to contract. The Federal Reserve also has the power to influence the money supply, which can influence the amount of money in circulation and the cost of money.

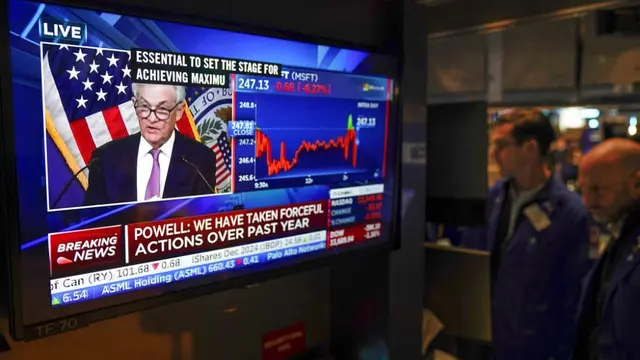

The Federal Reserve's decisions can have a significant impact on financial markets. When the Federal Reserve raises or lowers interest rates, the stock market often responds positively. The stock market may rally when the Federal Reserve lowers interest rates, as investors take advantage of the lower cost of borrowing. Similarly, when the Federal Reserve raises interest rates, the stock market may react negatively, as investors are discouraged from taking on new debt.

The Federal Reserve's decisions can also have an impact on the bond market. When the Federal Reserve raises interest rates, the value of existing bonds decreases, as the new bonds offer a higher return. Conversely, when the Federal Reserve lowers interest rates, the value of existing bonds increases, as the new bonds offer a lower return. This can have an impact on the bond market, as investors may be more likely to buy or sell bonds depending on the Federal Reserve's decisions.

The Federal Reserve's decisions can also influence the value of the U.S. dollar. When the Federal Reserve raises interest rates, the value of the dollar often increases, as investors are attracted to the higher return offered by the U.S. dollar. Conversely, when the Federal Reserve lowers interest rates, the value of the dollar may decrease, as investors are less likely to invest in the U.S. dollar. This can have an impact on the foreign exchange market, as investors may be more likely to buy or sell the U.S. dollar depending on the Federal Reserve's decisions.

The Federal Reserve's decisions can also influence the global economy. When the Federal Reserve raises interest rates, other countries may follow suit, as they are trying to keep their currency in line with the U.S. dollar. Conversely, when the Federal Reserve lowers interest rates, other countries may decide to lower their interest rates as well. This can have an impact on the global economy, as countries may be more likely to buy or sell goods and services from each other depending on the Federal Reserve's decisions.

Understanding The Role Of The U.S. Federal Reserve In Monetary Policy

The U.S. Federal Reserve plays an essential role in the economy of the United States as it is responsible for setting the nation’s monetary policy. This policy, in turn, impacts the entire economy, from the interest rates on mortgages to the value of the U.S. dollar. So, what does the U.S. Federal Reserve do in relation to monetary policy?

The Fed, as it is often referred to, is the central bank of the United States and is responsible for regulating the nation’s monetary system. It does this by setting the federal funds rate, which is the interest rate at which banks can borrow money from the Fed. The Fed also sets reserve requirements, which is the amount of money that banks must hold in reserve in order to be able to lend money to customers. The Fed also sets the discount rate, which is an interest rate that the Fed charges to banks when they borrow money.

The Fed’s monetary policy has a direct impact on the economy as a whole, as it can influence the amount of money available in the economy, the rate of inflation, and the exchange rate between the U.S. dollar and other currencies. A tight monetary policy, for example, would mean that the Fed increases the federal funds rate, which makes it more expensive for banks to borrow money and limits the amount of money available in the economy. This can help keep inflation in check and make it more difficult for businesses and individuals to borrow money. Conversely, a loose monetary policy would mean that the Fed decreases the federal funds rate, making it cheaper for banks to borrow money and making more money available in the economy. This can stimulate economic activity and help spur growth.

The Fed also has an important role to play in stabilizing financial markets. It can act to provide liquidity to markets during times of financial distress and can also intervene to prevent asset bubbles from forming. The Fed can also act as a lender of last resort to banks, providing them with the capital they need to stay afloat during times of financial stress.

The U.S. Federal Reserve plays an essential role in setting and implementing the nation’s monetary policy. It is responsible for setting the federal funds rate, reserve requirements, and discount rate, which all have a direct impact on the availability of money in the economy and the rate of inflation. The Fed also has an important role to play in stabilizing financial markets and providing liquidity during times of financial distress. By understanding the role of the Fed in the economy, it is easier to understand how monetary policy affects the entire country.