The U.S. Federal Reserve, commonly referred to as the Fed, is the central banking system of the United States. It is responsible for overseeing the nation's banking and financial systems and setting monetary policy. The Fed is responsible for setting interest rates, regulating the money supply, and providing banking services to the government and financial institutions. The Fed also has the authority to lend money to financial institutions in times of financial distress and to create new regulations to help ensure the stability of the financial system. In addition, the Fed serves as a lender of last resort, providing liquidity to the banking system and ensuring that the economy remains stable. Ultimately, the Fed works to promote economic prosperity and financial stability.

What does the U.S. Federal Reserve do?

Why does the Federal Reserve keep interest rates low?

The Federal Reserve is responsible for setting the interest rates for the US economy. Low interest rates are an important tool for the Fed to stimulate economic growth and prevent deflation. Low interest rates are beneficial for borrowers, as they can borrow money more cheaply and businesses can expand and hire more workers. Low interest rates also encourage people to save, as they are likely to get higher returns on their investments. Low interest rates generally help the economy by making it easier for businesses to borrow money and invest in growth. Low interest rates can also have a negative impact, however, as they can lead to asset bubbles and inflation. It is important for the Fed to strike a balance between stimulating the economy and avoiding the potential harms of low interest rates.

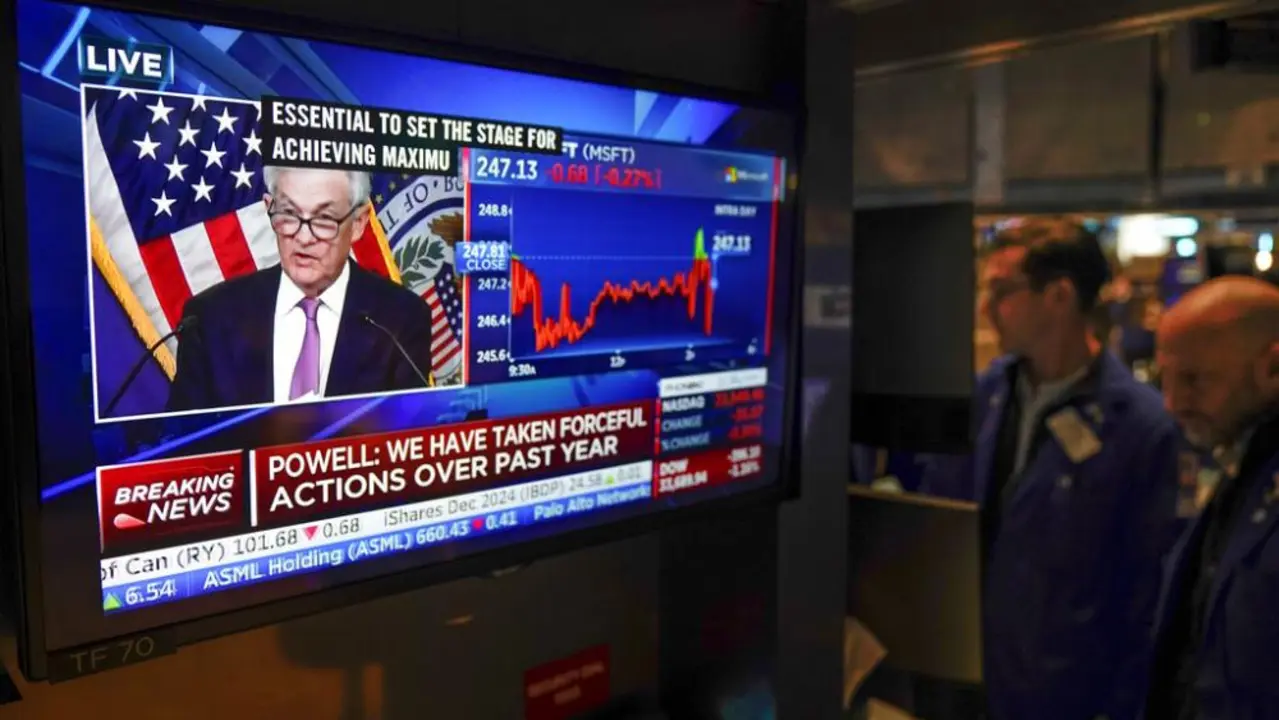

What does the Fed interest rate hike mean?

The Federal Reserve's decision to increase interest rates has the potential to have a significant impact on the economy. Higher rates can lead to increased borrowing costs for businesses and consumers, reducing spending power and potentially leading to a slowdown in economic growth. Consumers may also be hit by higher rates on credit cards, car loans, and mortgages, making it more expensive to borrow money. Additionally, higher rates can have a negative effect on stock markets, as investors may be discouraged from investing due to higher borrowing costs. Despite the potential for negative impacts, the Fed's decision to raise interest rates can also have a positive effect, as it can help to control inflation and encourage savings. Ultimately, the Fed's interest rate hike will have a wide-ranging impact on the economy and it is important to understand the potential implications before making any financial decisions.