Exploring the Benefits of Low Interest Rates for the US Economy

The Federal Reserve keeps interest rates low for a number of reasons, the most important being to stimulate the US economy. Low interest rates encourage borrowing and spending, which can help to increase economic growth. Low interest rates also make it easier for businesses and consumers to access credit, which can help to boost investment and consumption. This can be beneficial for the overall health of the economy.

Low interest rates can help to drive down unemployment rates. When businesses and consumers have access to more credit, they are more likely to invest and spend, which can help to create more jobs and reduce unemployment. In addition, low interest rates can help to reduce the cost of borrowing, making it easier for businesses and individuals to access the funds they need to grow and expand.

Low interest rates can also help to keep inflation in check. When borrowing costs are high, businesses and individuals tend to borrow less, which can help to prevent businesses from raising prices and can help to keep inflation low. Low interest rates can also help to keep the exchange rate between the US dollar and other currencies more stable, which can benefit the US economy.

Low interest rates can also help to keep the US economy competitive. When interest rates are low, businesses can access the funds they need to invest in new technologies and products, which can help to keep them competitive in the global economy. Low interest rates can also help to make the United States a more attractive destination for foreign investment, which can help to stimulate economic growth.

Finally, low interest rates can help to reduce the risk of financial crises. Low interest rates make it easier for businesses and individuals to borrow, which can help to reduce the risk of defaults and other financial crises. Low interest rates can also help to reduce the cost of capital for businesses, which can help to make it easier for businesses to invest and grow.

Analyzing the Federal Reserve's Role in Maintaining Low Interest Rates

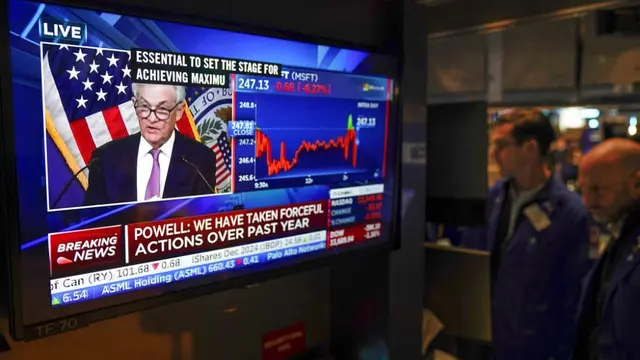

The Federal Reserve plays a major role in maintaining low interest rates. By controlling the supply of money in the economy, the Federal Reserve is able to influence the cost of borrowing money and, in turn, the interest rate.

The Federal Reserve has several tools it can use to influence interest rates. The most important of these tools is the federal funds rate, which is the rate at which banks lend to each other. When the Federal Reserve lowers the federal funds rate, it encourages banks to lend to each other at lower interest rates, which in turn lowers the cost of borrowing for businesses and consumers.

The Federal Reserve also has the ability to buy and sell government securities. When the Federal Reserve buys government securities, it injects money into the economy, which can help to lower interest rates. Conversely, when the Federal Reserve sells government securities, it removes money from the economy, which can help to raise interest rates.

The Federal Reserve also has the ability to directly influence interest rates through its policies. For example, the Federal Reserve can enact policies that encourage banks to lend more money to businesses and consumers at lower interest rates. This can help to reduce the cost of borrowing, which can help to keep interest rates low.

By using these tools, the Federal Reserve is able to influence interest rates in the economy. By keeping interest rates low, the Federal Reserve can help to stimulate economic growth, as businesses and consumers have an easier time obtaining financing and can invest in new projects or purchase goods and services. Low interest rates can also help to reduce unemployment, as businesses are more likely to hire new workers when it is cheaper to borrow money.

Why does the Federal Reserve keep interest rates low?

The Federal Reserve is the central banking system of the United States and is responsible for setting the country’s monetary policy. One of the most important tools the Federal Reserve has to influence the economy is the setting of interest rates. Low interest rates can have an impact on consumer spending and the overall health of the economy.

Examining the Impact of Low Interest Rates on Consumer Spending

Low interest rates can have a positive impact on consumer spending. When interest rates are low, it becomes easier for people to borrow money to purchase items such as cars and homes. Low interest rates also make it easier for people to pay off existing debt. This frees up money that can then be spent on other items. Low interest rates can also lead to an increase in investments, as investors are more likely to take risks when they can borrow money cheaply.

Low interest rates can also lead to an increase in inflation, as more money is being circulated in the economy. This can lead to an increase in prices, which can make it difficult for people to afford the things they need. For this reason, the Federal Reserve must be careful to keep interest rates low enough to encourage consumer spending, but not so low that inflation becomes a problem.

Low interest rates can also lead to a decrease in savings, as people are more likely to spend money when they can borrow it cheaply. This can be problematic for the long-term health of the economy, as savings are necessary for investments. For this reason, the Federal Reserve must be careful not to keep interest rates too low for too long.

In conclusion, low interest rates can have a positive impact on consumer spending, but the Federal Reserve must be careful not to keep interest rates too low for too long. Low interest rates can lead to an increase in inflation and a decrease in savings, which can have a negative impact on the economy in the long run. For this reason, the Federal Reserve must be mindful of the impact of low interest rates on the overall economic health of the nation.