Explaining the Impact of the Fed Interest Rate Hike on Consumers

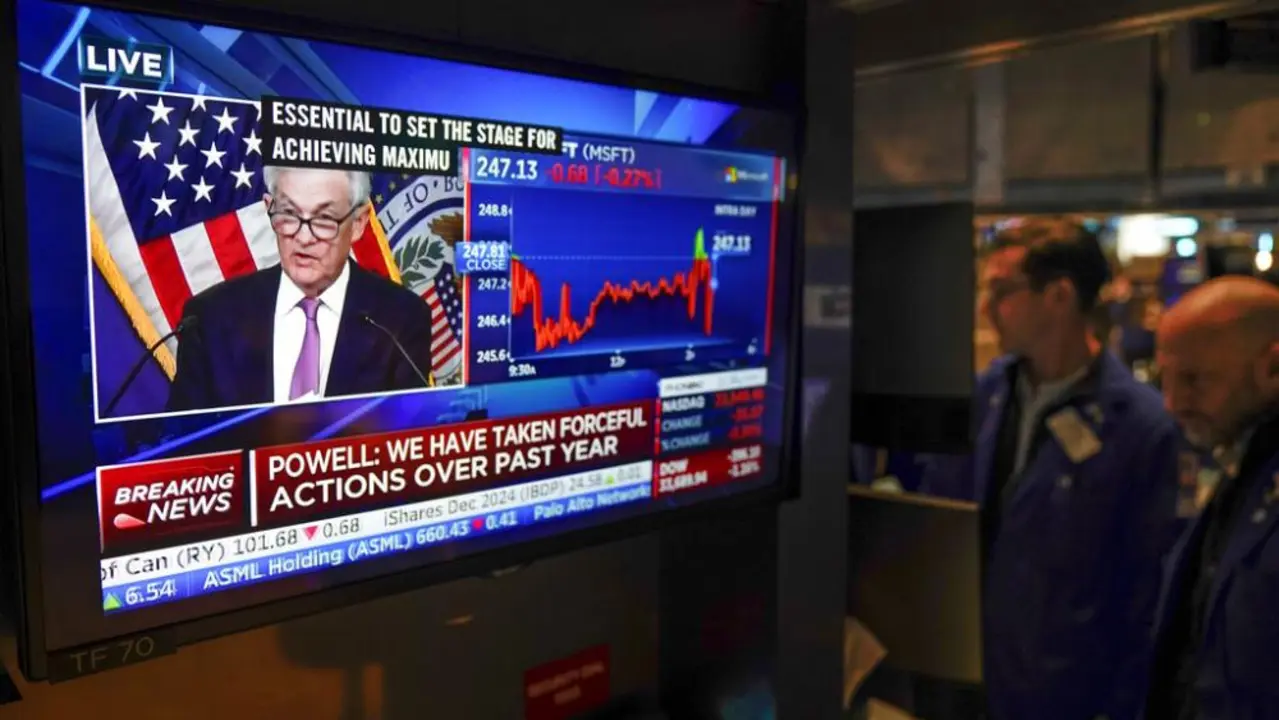

The Federal Reserve recently increased interest rates, a decision that has a direct impact on consumers. The hike in interest rates can have a dramatic effect on consumers' spending and saving habits, as well as their overall financial health. It is important for consumers to understand the implications of the Fed's decision and how it could affect them.

One of the most significant impacts of the Fed's rate hike is on borrowing costs. The interest rate increase will lead to higher costs for consumers who are taking out loans, such as mortgages and credit cards. Homeowners with adjustable-rate mortgages will be particularly affected, as their monthly payments will likely increase. Credit card holders should expect to pay more in interest charges on their credit cards as well.

The interest rate hike will also affect the savings of consumers. As interest rates increase, so do the rates offered on savings accounts and certificates of deposit. This means that consumers who have money in these accounts will earn more on their savings, but it also means that borrowers will pay more in interest when they borrow. The higher interest rate on savings accounts also means that it may be more difficult for consumers to save money.

The interest rate hike will also have an effect on the stock market. When the Fed increases rates, it often leads to a decrease in stock prices, as investors become less willing to purchase stocks. This could have a negative effect on those who are invested in the stock market, as the value of their investments could decrease.

The Fed's decision to raise interest rates could also have an effect on the housing market. As borrowing costs increase, the cost of buying a home could become too expensive for some consumers. This could lead to a decrease in home sales and a decrease in home prices. This could have a negative impact on those who are trying to buy a home, as it could make it more difficult for them to afford a home.

The Federal Reserve's decision to raise interest rates can have a wide range of effects on consumers. It is important for consumers to understand the implications of the Fed's decision and how it could affect them. By understanding the impact of the rate hike on their borrowing and saving habits, as well as on their investments, consumers can make better decisions about their financial future.

How the Fed Interest Rate Hike May Affect the Economy

The Federal Reserve's decision to raise interest rates could have some big implications for the economy. The Fed's main goal is to keep inflation under control and ensure the stability of the economy. But, it's important to understand how this decision could impact individuals and businesses.

For starters, raising interest rates will make it more difficult for individuals and businesses to borrow money. This could mean that people have a harder time taking out loans for things like cars and homes. It could also affect businesses who rely on borrowing money to invest in new projects or expand their operations. As loan costs increase, businesses may have to reduce the amount they can borrow or pass on the higher costs to their customers.

Raising interest rates can also affect the stock market. When the cost of borrowing money increases, it can cause investors to be more cautious and less likely to buy stocks. This can lead to lower stock prices and a decrease in investors' confidence. This could have a ripple effect on the overall economy.

The Fed's decision to raise interest rates can also have an impact on savings accounts. When banks raise interest rates, it means that savers will earn more money on their deposits. This can be beneficial for savers, but it could also encourage people to save more instead of spending. This could lead to less consumer spending, which could hurt the overall health of the economy.

The Fed's decision to raise interest rates may also have an effect on the dollar. A stronger dollar is generally seen as a sign of a strong economy, but it can also make imported goods more expensive. This could make it harder for businesses to compete with foreign competitors and lead to a decrease in exports.

The bottom line is that the Federal Reserve's decision to raise interest rates could have a big impact on the economy. It's important to understand how this decision could affect individuals, businesses, and the stock market. It's also important to remember that the Fed is trying to keep the economy stable and keep inflation under control.

What Small Business Owners Need to Know About the Fed Interest Rate Hike

The Federal Reserve recently announced a 0.25% increase in interest rates, and this has small business owners wondering what it means for them. The answer is that it depends on the type of business you own and how you use debt. This article will explain the implications of the Fed's decision for small businesses.

1. Higher Interest Rates on Loans

The first thing that small business owners need to know is that the Fed's interest rate hike will mean higher interest rates on loans. This means that if you need to borrow money for your business, you will be paying more for the loan than you would have before the interest rate hike. However, it is important to note that the increase is relatively small and may not have a significant impact on most small businesses.

2. Higher Interest Rates on Savings

The second impact of the Fed's rate hike is that it will mean higher interest rates on savings. This is important for business owners who have money in the bank and are looking to earn more on their investments. The higher interest rates may be beneficial for those with a large amount of savings, but it is important to remember that the increase is relatively small and may not make a huge difference in the amount of money you can earn on your investments.

3. Increased Pressure on Credit Card Rates

The third impact of the Fed's rate hike is that it may put increased pressure on credit card rates. Credit card companies often follow the Fed's lead when it comes to setting interest rates, so the rate hike could mean that credit card companies will increase their rates as well. This could be a problem for small business owners who rely on credit cards to fund their businesses, so it is important to be aware of the potential impacts of the rate hike.

4. Increased Risk of Default on Loans

Finally, the Fed's interest rate hike could mean that there is an increased risk of default on loans. As interest rates increase, it could be more difficult for businesses to manage their debt and make their payments on time. This could put businesses in a precarious financial situation, so it is important to be aware of the potential risks associated with the rate hike.

The Fed's interest rate hike may have implications for small businesses, so it is important for business owners to understand the potential impacts on their business. By understanding the implications of the rate hike, small business owners can make sure that they are prepared for any potential changes in the economy.

How the Fed Interest Rate Hike Could Impact Homeowners

The Federal Reserve recently announced it was raising interest rates for the first time since 2008. This increase in the federal funds rate could have an effect on homeowners in a variety of ways. Homeowners should be aware of what the Fed interest rate hike means and how it could affect them.

Mortgage Rates Could Increase

One of the biggest effects of the Fed interest rate hike will be on mortgage rates. While the Fed doesn't directly control mortgage rates, they do have an indirect effect. When the federal funds rate increases, it can lead to an increase in mortgage rates. Since the Fed's rate increase was the first in nearly a decade, it could mean an increase in mortgage rates.

Higher Interest Rates on Credit Cards

The Fed interest rate hike could also lead to higher interest rates on credit cards. Banks and other lenders will likely raise their interest rates to offset the increase in the federal funds rate. This means that homeowners will have to pay higher interest on their credit card balances and could lead to an increase in monthly payments.

Adjustable-Rate Mortgages Could See a Spike

Homeowners with adjustable-rate mortgages could also see an increase in their monthly payments. With the federal funds rate hike, lenders may raise the interest rates on adjustable-rate mortgages. This could mean homeowners will have to pay more each month on their mortgage payments.

More Expensive Home Equity Loans

The Fed interest rate hike could also make home equity loans more expensive. Since home equity loans are typically based on the prime rate, the increase in the federal funds rate could lead to an increase in the prime rate. This could mean homeowners will have to pay more interest on any home equity loans they take out.

Increased Refinancing Costs

Homeowners who are looking to refinance their mortgages could also see an increase in their costs. With the Fed interest rate hike, lenders may charge higher fees for refinancing. This could mean homeowners will have to pay more in closing costs when they refinance their mortgages.

Conclusion

The Fed’s recent interest rate hike could have a wide-reaching effect on homeowners. Mortgage rates, credit card interest rates, adjustable-rate mortgages, home equity loans and refinancing costs could all be impacted by the increase in the federal funds rate. Homeowners should be aware of how the Fed interest rate hike could affect them and take steps to minimize the impact.

What Does the Fed Interest Rate Hike Mean?

The Federal Reserve recently raised the interest rate, and this news has left many investors wondering what the implications are. The interest rate hike is a signal that the Federal Reserve believes the economy is strong enough to handle a rate increase, and it is also a signal that the Fed believes inflation is likely to occur in the near future. This news can have a significant impact on investors, so it is important to understand what the Fed interest rate hike means and how it could affect your investment strategies.

Investing Strategies to Consider in Light of the Fed Interest Rate Hike

When the Federal Reserve raises the interest rate, it often has an impact on the stock market. Many investors believe that when interest rates are increased, stocks become less attractive investments. Therefore, it is important to consider how the Fed interest rate hike could affect your investments. Here are a few strategies that investors should consider in light of the recent rate hike.

- Diversify Your Portfolio: One of the best strategies for dealing with the Fed interest rate hike is to diversify your portfolio. By investing in different asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the risk of your investments and potentially benefit from the rate hike.

- Rebalance Your Portfolio: Rebalancing your portfolio periodically is also important. This entails selling off assets that have risen in value and buying assets that have fallen in value. This ensures that your portfolio is well balanced and that you are taking advantage of opportunities that may arise in the wake of the rate hike.

- Look for Low Risk Investments: The Fed interest rate hike also means that it is a good time to look for low risk investments. Treasury bonds, for example, are often considered to be some of the safest investments available. While these investments may not offer the highest returns, they can provide a measure of security in the face of rate hikes.

- Invest in Inflation-Protected Assets: Inflation is one of the main concerns when the Fed raises the interest rate. To protect your investments from inflation, you should consider investing in assets such as gold and other commodities that tend to rise in value as inflation increases.

- Invest in Index Funds: Index funds are a type of mutual fund that tracks a specific market index. These funds offer diversification, low fees, and are generally less risky than individual stocks. Investing in index funds can help you take advantage of the rate hike without taking on excessive risk.

The Fed interest rate hike can have a significant impact on your investments. It is important to understand the implications of the rate hike and consider how it could affect your strategies. By diversifying your portfolio, rebalancing it, looking for low risk investments, investing in inflation-protected assets, and investing in index funds, you can reduce the risk and potentially benefit from the rate hike.