The interest rate has been hovering around 5.5% for some time, but many economists are predicting it will begin to rise soon. With the US economy continuing to grow and the Federal Reserve looking to tighten monetary policy, it's likely that the rate will start to move up. However, it's impossible to predict exactly where it will end up, as there are many factors that can affect the interest rate. The good news is that there are still ways to protect yourself from any potential increases, such as shopping around for the best interest rates and locking in a fixed rate mortgage. Ultimately, the only way to know for sure if the rate will go up is to stay informed and be ready to adjust your financial plans accordingly.

Is the interest rate going to go up above 5.5%?

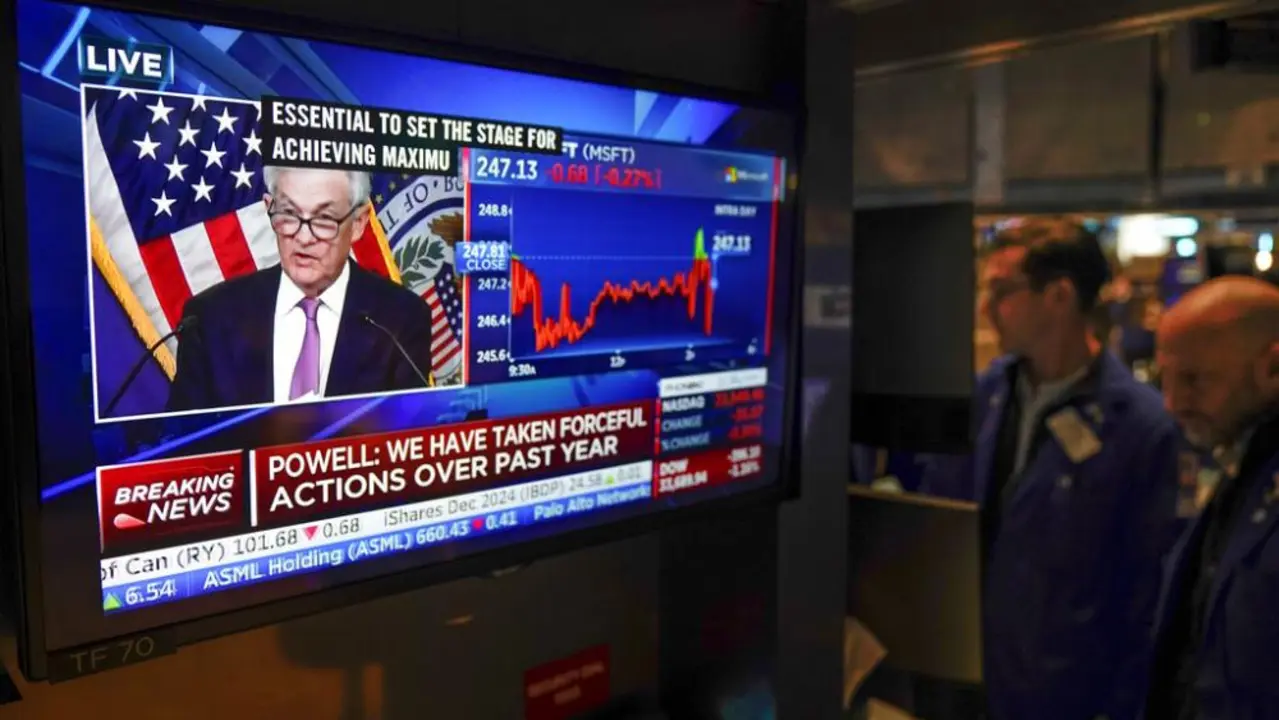

What does the Fed interest rate hike mean?

The Federal Reserve's decision to increase interest rates has the potential to have a significant impact on the economy. Higher rates can lead to increased borrowing costs for businesses and consumers, reducing spending power and potentially leading to a slowdown in economic growth. Consumers may also be hit by higher rates on credit cards, car loans, and mortgages, making it more expensive to borrow money. Additionally, higher rates can have a negative effect on stock markets, as investors may be discouraged from investing due to higher borrowing costs. Despite the potential for negative impacts, the Fed's decision to raise interest rates can also have a positive effect, as it can help to control inflation and encourage savings. Ultimately, the Fed's interest rate hike will have a wide-ranging impact on the economy and it is important to understand the potential implications before making any financial decisions.