Inflation is a major economic concern if it rises too quickly. If inflation is 50 percent per month, this means that prices for goods and services are rising dramatically, and the cost of living for citizens can be extraordinarily high. This type of rapid inflation can cause economic hardship for individuals, businesses, and governments alike. It can lead to job losses, reduced wages, and a decrease in the purchasing power of people's money. High inflation can also reduce investment in businesses and cause currency devaluation. Ultimately, when inflation is so high, it can have a devastating effect on an economy.

What happens if inflation is 50 percent per month?

What happens to interest rates when the economy slows down?

When the economy slows down, interest rates tend to go down as well. This is because central banks, such as the Federal Reserve in the United States, will lower interest rates in order to stimulate the economy. Lowering interest rates makes it cheaper for businesses to borrow money, which can help to fuel economic growth. Lower interest rates also tend to make it easier for consumers to borrow money, which can help to increase spending and stimulate the economy. The opposite is true when the economy is doing well; interest rates tend to go up as central banks try to prevent the economy from overheating.

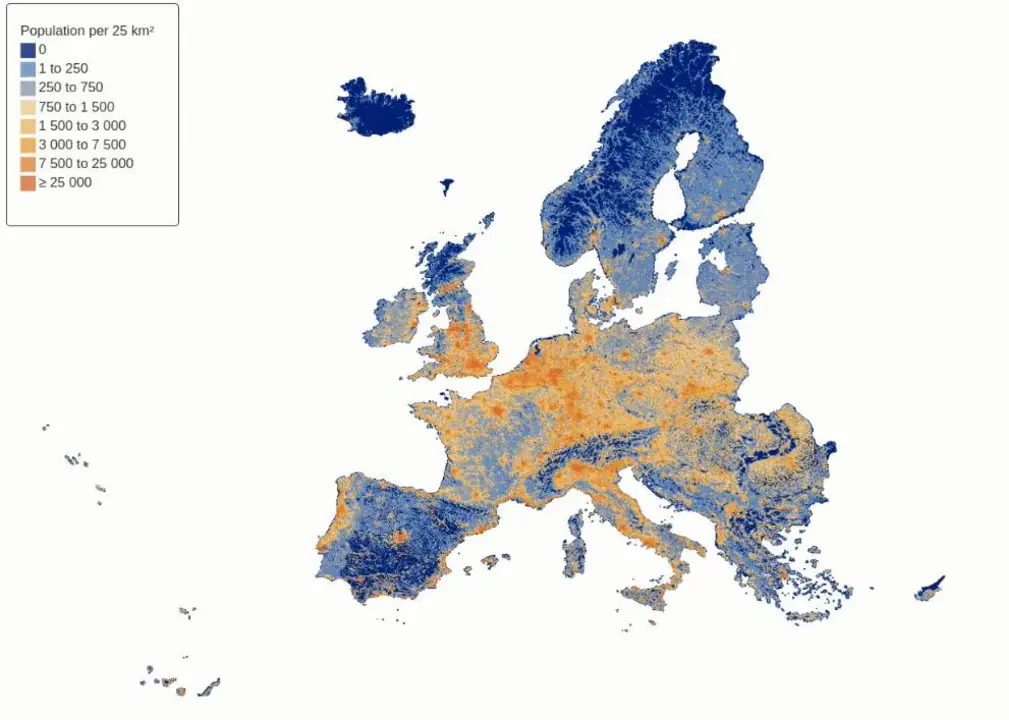

How do economies of density work?

Economies of density are the economic benefits that arise from a high concentration of population and businesses in a specific area. This concept is based on the idea that the more people living and working in an area, the more resources and opportunities will be available, thus making it an attractive place to live and do business. Economies of density can also refer to the increased productivity that arises from having a large number of people and businesses concentrated in one area. By reducing the cost of transportation and communication, this concentration of people and businesses can lead to increased efficiency and productivity. Economies of density can also increase the amount of employment opportunities available in the area, which can help stimulate economic growth. Overall, economies of density can create a positive economic impact on an area, making it an attractive place to live and do business.

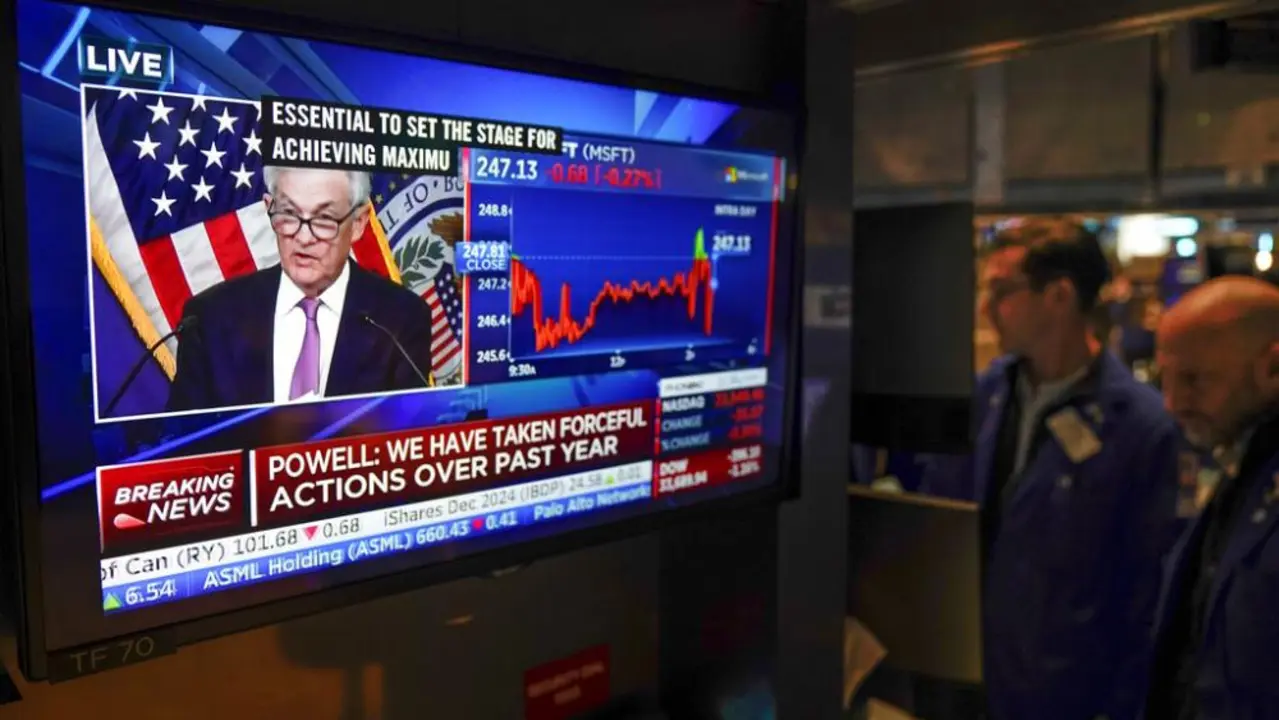

Why does the Federal Reserve keep interest rates low?

The Federal Reserve is responsible for setting the interest rates for the US economy. Low interest rates are an important tool for the Fed to stimulate economic growth and prevent deflation. Low interest rates are beneficial for borrowers, as they can borrow money more cheaply and businesses can expand and hire more workers. Low interest rates also encourage people to save, as they are likely to get higher returns on their investments. Low interest rates generally help the economy by making it easier for businesses to borrow money and invest in growth. Low interest rates can also have a negative impact, however, as they can lead to asset bubbles and inflation. It is important for the Fed to strike a balance between stimulating the economy and avoiding the potential harms of low interest rates.

What is the impact of the inflation rate on the GDP growth rate?

Inflation is one of the primary factors that can affect the GDP growth rate of a country. When the inflation rate rises, the purchasing power of the currency decreases, which reduces the amount of goods and services that can be purchased. This can have a direct impact on the GDP growth rate as it slows the rate of economic growth. Additionally, if inflation is left unaddressed, it can lead to rising unemployment and an overall decrease in the standard of living. Therefore, it is important for governments to take steps to manage the inflation rate in order to ensure a healthy economy.

Why does inflation (in the economy) exist, and who controls it?

Inflation is an unavoidable part of life in any economy, but it doesn't have to spiral out of control. Inflation is the rise in prices of goods and services over a period of time, and is usually caused by an increase in the money supply. Inflation is controlled by central banks, which use monetary policy to manage the money supply and set interest rates to keep inflation within a target range. Inflation can be good or bad depending on the situation, but it's always important to keep it under control. If inflation becomes too high, it can cause economic instability, which can lead to recession or even depression. By controlling inflation, central banks can help ensure that prices don't rise too quickly, allowing the economy to stay stable and healthy.

What is the relationship between Economic growth and GDP?

The relationship between economic growth and Gross Domestic Product (GDP) is a critical one. Economic growth is the rate at which a country’s economy is expanding, usually measured as a percentage. GDP is the total market value of all goods and services produced by a country in a given year. GDP is the most commonly used measure of economic growth and is an important indicator of the health of an economy. GDP is an important indicator of a country's economic strength, and economic growth and GDP are closely linked. As GDP grows, so does economic growth, which in turn leads to increased job opportunities, higher incomes, and improved living standards. Conversely, a decline in GDP can lead to a recession and a decrease in economic growth.

How does a change in interest rates impact economic growth?

Interest rates are a key factor in the growth of an economy. When the interest rate is adjusted, it can have a direct impact on the spending, borrowing, and saving habits of consumers and businesses. An increase in the interest rate can reduce the amount of money people are willing to borrow and spend, reducing economic activity. On the other hand, a decrease in the interest rate can create an environment of increased borrowing and spending, which can lead to economic growth. As such, a change in interest rates can have a significant impact on an economy's growth. Therefore, it is important that businesses and governments consider the effects of changing interest rates when formulating economic policies.

How do you measure inflation?

Inflation is an important economic indicator that measures the rate at which the prices of goods and services rise over time. It is a key factor in determining how the economy is performing and how it can impact the cost of living for individuals and businesses. Inflation is typically measured by comparing the Consumer Price Index (CPI) to the inflation rate over a specific period of time. Other methods of measuring inflation include the Producer Price Index (PPI) and the labor cost index. The Federal Reserve Board also uses a variety of measures to assess the inflation rate. By understanding how inflation is measured, individuals and businesses can better plan for the future and adjust their spending accordingly.

What does the Fed interest rate hike mean?

The Federal Reserve's decision to increase interest rates has the potential to have a significant impact on the economy. Higher rates can lead to increased borrowing costs for businesses and consumers, reducing spending power and potentially leading to a slowdown in economic growth. Consumers may also be hit by higher rates on credit cards, car loans, and mortgages, making it more expensive to borrow money. Additionally, higher rates can have a negative effect on stock markets, as investors may be discouraged from investing due to higher borrowing costs. Despite the potential for negative impacts, the Fed's decision to raise interest rates can also have a positive effect, as it can help to control inflation and encourage savings. Ultimately, the Fed's interest rate hike will have a wide-ranging impact on the economy and it is important to understand the potential implications before making any financial decisions.