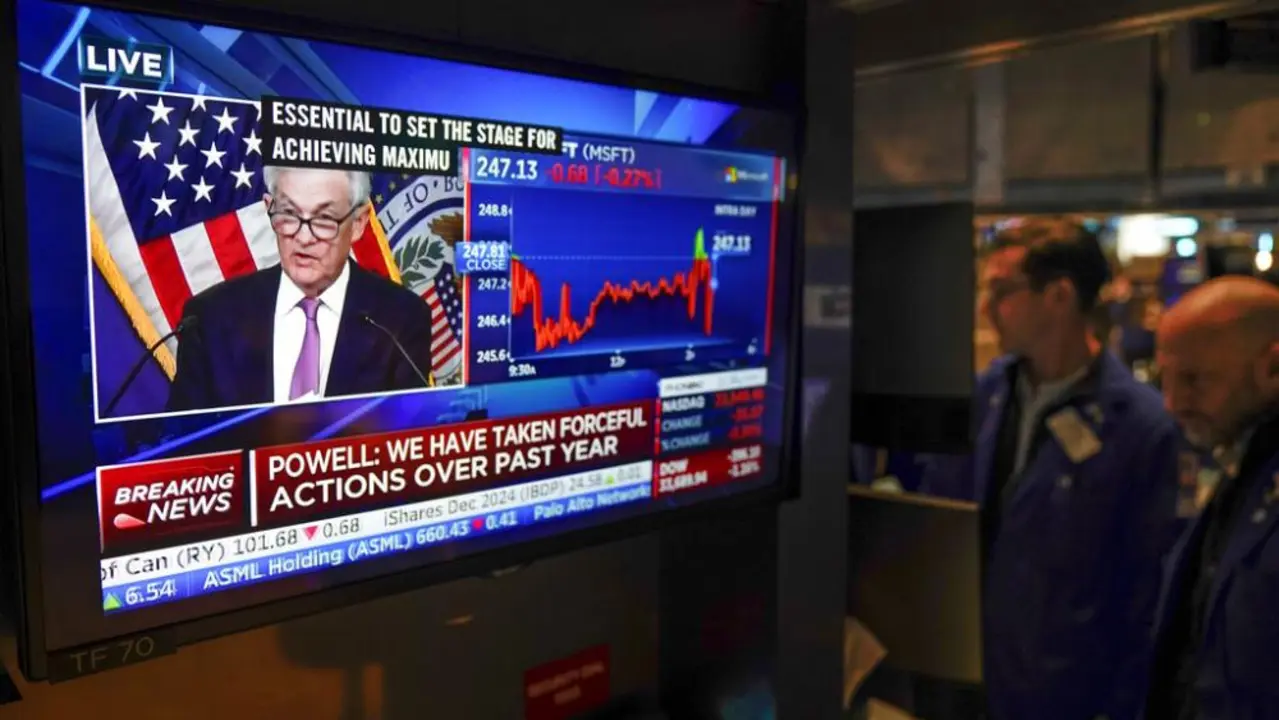

The Federal Reserve's decision to increase interest rates has the potential to have a significant impact on the economy. Higher rates can lead to increased borrowing costs for businesses and consumers, reducing spending power and potentially leading to a slowdown in economic growth. Consumers may also be hit by higher rates on credit cards, car loans, and mortgages, making it more expensive to borrow money. Additionally, higher rates can have a negative effect on stock markets, as investors may be discouraged from investing due to higher borrowing costs. Despite the potential for negative impacts, the Fed's decision to raise interest rates can also have a positive effect, as it can help to control inflation and encourage savings. Ultimately, the Fed's interest rate hike will have a wide-ranging impact on the economy and it is important to understand the potential implications before making any financial decisions.

March 14, 2023

What does the Fed interest rate hike mean?